In recent years, the forex market has seen a significant transformation, mainly driven by technological advancements. One of the most profound innovations in this field is the development of Forex AI trading bots. These automated programs utilize artificial intelligence to analyze market data and execute trades, offering a plethora of benefits for traders ranging from novices to seasoned professionals. As the landscape of Forex trading continues to evolve, understanding the inner workings and advantages of AI trading bots has never been more pertinent. For comprehensive insights into this evolving technology, visit forex ai trading bot seed2019.io.

What is a Forex AI Trading Bot?

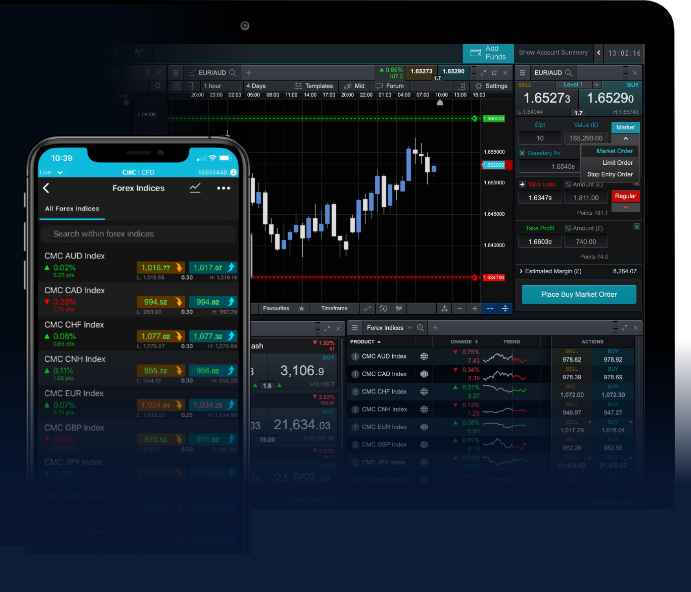

A Forex AI trading bot is a software application that uses algorithms and machine learning models to trade currency pairs in the foreign exchange market. These bots operate 24/7, scanning the market for trading opportunities based on predefined strategies or learned behaviors from historical data. They can analyze large volumes of data far more quickly than a human trader, allowing them to execute trades effectively and efficiently.

The Technology Behind AI Trading Bots

At the core of AI trading bots is machine learning, a subset of artificial intelligence that focuses on building systems that can learn from and make predictions based on data. In the context of Forex trading, bots utilize historical market data to understand price movements and predict future trends. There are several key technologies and methodologies that underpin the operation of these bots:

- Data Mining: AI trading bots analyze vast amounts of historical data, identifying patterns and correlations that can inform future trading decisions.

- Neural Networks: These complex algorithms mimic the human brain’s functioning, enabling bots to learn from data and improve their trading strategies over time.

- Natural Language Processing (NLP): Some trading bots incorporate NLP to gauge market sentiment based on news articles, social media, and economic reports, helping them make informed trading decisions.

Benefits of Using Forex AI Trading Bots

Implementing Forex AI trading bots offers numerous advantages:

- Emotionless Trading: Unlike human traders, AI trading bots do not get swayed by emotions, making decisions purely based on data and pre-set parameters. This mitigates the risk of emotional biases, which can lead to poor trading decisions.

- Speed and Efficiency: This technology allows for the rapid analysis of market data and execution of trades, often in milliseconds. This speed can be crucial in the fast-paced world of forex trading where timing is everything.

- 24/7 Market Access: AI trading bots can operate around the clock without fatigue, taking advantage of global markets and trading opportunities at any time.

- Backtesting Capabilities: Traders can use historical data to test their trading strategies with AI bots, allowing for optimization before real capital is employed.

- Diversification: Bots can manage multiple trading accounts and strategies simultaneously, spreading risk and potentially increasing profitability.

Challenges and Considerations

While Forex AI trading bots offer significant advantages, they are not without their challenges. Important considerations include:

- Market Volatility: Forex markets can be unpredictable, and even the most sophisticated algorithms can struggle during periods of extreme volatility.

- Overfitting: A common risk in AI trading is overfitting, where a model is too closely aligned with historical data and fails to perform well with new, unseen data.

- Dependence on Technology: Traders must remain aware that technical failures can occur. Internet outages and software glitches can affect performance and result in financial losses.

- Security Risks: Cybersecurity threats pose substantial risks, and users should ensure they employ measures to protect their accounts and data.

Getting Started with Forex AI Trading Bots

For those interested in leveraging Forex AI trading bots, here are some steps to get started:

- Choosing the Right Platform: Numerous online platforms offer AI trading bots, each with varying features, costs, and performance histories. It’s essential to do thorough research to choose a reputable provider.

- Defining Trading Strategy: Identify your trading goals and risk tolerance, which will help determine your bot’s algorithms and settings.

- Backtesting: Before using real money, extensively backtest your bot with historical data to gauge its potential effectiveness.

- Monitoring Performance: Continuously monitor your bot’s performance, making adjustments to algorithms and settings as needed to adapt to changing market conditions.

Future of Forex AI Trading Bots

As technology continues to advance, the capabilities of AI trading bots are expected to expand. Developments in machine learning, processing power, and data analytics promise to refine the predictive abilities of these systems, paving the way for even smarter trading solutions. Moreover, as more traders adopt AI technology, understanding how these intricate algorithms operate will be an essential skill in maintaining a competitive edge in the forex market.

Conclusion

The emergence of Forex AI trading bots represents a revolutionary shift in how traders approach the foreign exchange market. With their ability to analyze data efficiently, make informed trades, and operate continuously, AI trading bots offer substantial benefits while posing some inherent risks. By thoughtfully implementing these technologies and continuously monitoring their performance, traders can harness the power of AI to enhance their trading strategies and potentially achieve greater success in the dynamic world of Forex trading.